by Samuel K. Darling, Business Law Attorney at Genesis Law Firm, PLLC and Lemuel J. Lim, LL.B.(Hons)(UK), LL.M. (UK), LL.M Tax (US).

There are many ways to value a small business you’re buying or selling. This article tells you what you need to know, simply as possible, with different tools for different size transactions. It does not offer information on market price valuations, especially purchasing or selling publicly traded companies – large companies whose stock trades on public exchanges. Instead this article focuses on private transactions where reliable market prices often aren’t available, such as the purchase and sale of “mom and pop shops” and other modest-size businesses.

This is the first part of a series of articles that will go through traditional methods on how to value a small business. The series also includes an article devoted to giving helpful information on getting an expert appraiser to help with the valuation of a business. In this article, we give a high-level summary of key points to note when approaching the valuation of a business for those who don’t have time to go into detail. We also look at key principles to note when approaching technical methods of valuation.

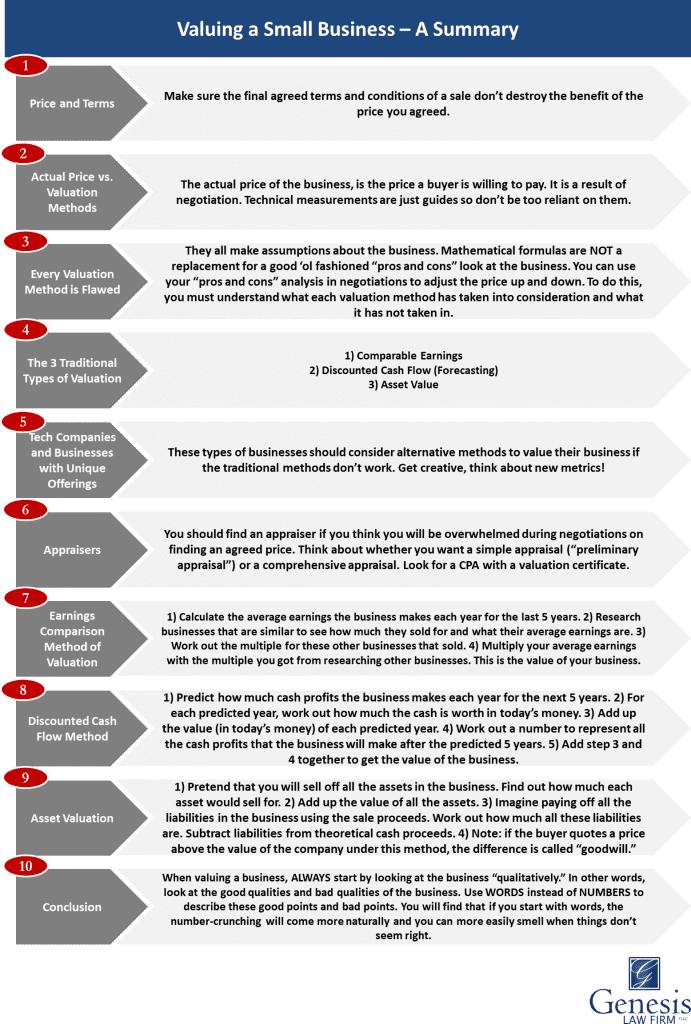

SUMMARY

If you don’t have time to look at all 5 parts in this series, here is a cheat sheet summary:

MEASURING VALUE: AN INTRODUCTION

I. Look at Price in Conjunction with the Terms

When negotiating a price for the sale of the business, the number one concern for both the buyer and the seller is price. But price alone should not be the sole measure for how valuable the business is. True, parties may come to an agreed price that seems favorable to either the buyer or seller (or both), but the sale could be crippled by the terms contained in the agreement. Unfavorable terms could then result in the sale being costly, risky, or simply unpalatable. Parties to a sale of a business should therefore be careful not to “switch off” once an indicative price has been agreed – the work has only just begun! The parties will now need to understand what the terms of the sale are: “the devil is in the details!”

II. What is the Price of the Business?

You may have been made aware of various “technical” measurements that experts use to calculate how much a business is worth. These technical measurements are just guides. The actual price is ultimately determined simply by what a buyer is willing to pay.

What a buyer is willing to pay is based on a buyer’s perceived value (what the buyer subjectively thinks the business is worth). The buyer’s perceived value can be determined by different factors such as:

- what they think the market conditions are;

- what their strategic plans for the business are

once they have bought the business;

- what the tax consequences are for the sale;

- whether they know there are other potential

buyers looking to buy the business; and

- the general laws of supply and demand.

Technical measurements sometimes don’t take these other factors into account properly. Here are some important lessons to take note of from this understanding:

- Firstly, sellers should not be put off from

selling simply because they believe their business has no value.

A seller may not think that the business has any real value, BUT if there is a

buyer out there willing to pay to gain control of the seller’s business, then

that business has value. In certain circumstances, a business may have value

even if the business is generally not profitable, or even operating at a big loss!

- Secondly, buyers and sellers should escape

the mindset that there is such a thing as a “fixed price” for the business.

Valuation should not be based solely on mathematical formulas. When you

approach valuation, ask yourself: “what are the pros and cons of the business?”

- Thirdly, experts can give “numbers” for the

business, but they don’t know the business like an owner does. If you

wanted to hire an outside expert to do technical valuations, they can help give

you a “number” for the business. But, only the business owners are

familiar enough with the operations of the business to know the “pros and cons”

of the business. These pros and cons will adjust

the number calculated by you or the expert up or down. Buyers will need to do

something called “due diligence” to understand the business more. They can then

look at the “pros and cons” themselves.

- Fourthly, technical methods of valuation are

just different ways of looking at the business. No single method

provides a price without question. They are merely different camera angles that

tell a story about the business from a different viewpoint. But all technical

calculations make assumptions about

the business. You should understand what these assumptions are. If you have

hired an outside expert to help you with the technical calculations, do not be

ashamed to press them to tell you what assumptions they have made.

III. The Three Traditional Types of Valuation Methods

Business valuations fall into three traditional categories of methodology:

- Comparable Earnings. How much the business is earning compared to other similar businesses. In some industries, especially those that offer “services,” this method makes more sense when large expensive equipment or other assets are not that important to how a business makes money. See The Main Way to Value a Business article.

- Discounted Cash Flow (Forecasting). The future cash (after expenses) generated by the business in today’s value. Forecasting aims to be more precise by looking at an actual business and its situation in more detail. This is more work and the risk of error comes from the buildup of the many assumptions that need to be made. This method is usually more relevant for newer businesses that may not have turned a profit but have very high growth potential. See Cash Flow Valuation article.

- Assets. How much the business assets are worth if you sold them rather than trying to run the company. In heavy manufacturing industries, expensive equipment and assets are usually more important to run the business. This method is usually more relevant in these situations. See Asset Valuation article.

There are many variations on the methods mentioned above, as well as other methods that could potentially be used. We recommend sticking to the three methods in this article as your starting point.

IV. New Ways of Valuing a Business

Technology has changed the way we look at how to value a business. Even for smaller tech or science companies, it has been pretty common to use other measurements to determine how much the business is worth. For example, internet companies may have valuations focused on the number of active users rather than how much money they make. The apparent reason why is because the business may not be mature enough to use traditional methods of valuing a business. I know what some of you may be thinking, but we can leave the question of whether this is a proper way to value a business to the academics.

The point we are trying to make is that if you think the traditional methods of valuing a business won’t produce a price range that adequately reflects the true value of a business, it is possible to get creative and think of other ways! So long as the buyer and seller are both open to considering non-traditional methods, they can be used in negotiation. If the business in question is an internet company, a tech company, a business with lots of research & development, or the business has a unique or unusual offering, then a party to a sale should seriously starting thinking outside the box.

We hope you found this article helpful. Our firm believes in making expert-quality information available online free of charge; and, in that vein, we’ve written on numerous related topics. We encourage you to visit our firm’s business resource page.